Capgemini (Euronext Paris: CAP) has announced that it has entered into a definitive agreement to acquire WNS (Holdings) Limited (NYSE: WNS), a provider of business process management services. The all-cash transaction is valued at $76.50 USD per WNS share, amounting to a total consideration of $3.3 billion USD, excluding WNS’s net financial debt.

The acquisition price represents a 17% premium to the last closing share price on July 3, 2025, and a 28% premium over the 90-day volume-weighted average price. The deal has received unanimous approval from the boards of directors of both companies and is expected to close by the end of 2025, subject to customary regulatory and shareholder approvals.

The stated goal of the acquisition is to combine Capgemini’s technology and consulting capabilities with WNS’s specialization in Digital Business Process Services (BPS) to address growing enterprise demand for AI-driven operational transformation.

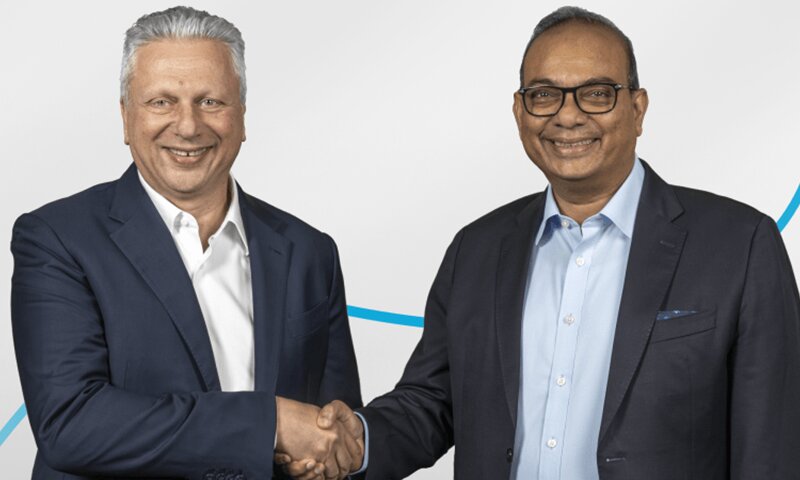

“Enterprises are rapidly adopting Generative AI and Agentic AI to transform their operations end-to-end. Business Process Services will be the showcase for Agentic AI,” commented Aiman Ezzat, chief executive officer of Capgemini. “Capgemini’s acquisition of WNS will provide the group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS to Agentic AI-powered Intelligent Operations,” Ezzat added.

WNS has established a client base across several industries, serving companies such as United Airlines, Aviva, M&T Bank, Centrica, and McCain Foods. For its 2025 fiscal year, WNS reported revenues of $1.266 billion USD with an operating margin of 18.7%.

The transaction is positioned to enhance Capgemini’s Business Services division and expand its footprint in the US market.

“By combining our deep domain and process expertise with Capgemini’s global reach, cutting-edge Gen AI and Agentic AI capabilities, a robust partner ecosystem, and advanced technology platforms, we are creating a powerful proposition that accelerates enterprise reinvention,” said Keshav R. Murugesh, chief executive officer of WNS.

Timothy L. Main, chairman of the WNS board of directors, added, “I’m confident that Capgemini is the ideal partner at the right time in WNS’ journey to extend our capabilities, accelerate innovation, and establish a leadership position in this rapidly evolving market.”

Financial and Transaction Details

Capgemini projects the acquisition will be accretive to its normalized earnings per share (EPS) by 4% in 2026 before synergies, and by 7% in 2027 once synergies are realized. The company anticipates generating revenue synergies between €100 million EUR and €140 million EUR by the end of 2027, with cost and operational synergies expected to reach an annual pre-tax run-rate of €50 million EUR to €70 million EUR in the same timeframe.

Based on 2024 figures, the combined entities would have generated approximately €23.3 billion EUR in revenue and a 13.6% operating margin.

To fund the acquisition, Capgemini has secured a bridge financing facility of €4.0 billion EUR. The company plans to refinance this amount using approximately €1.0 billion EUR in available cash and the remainder through new debt issuance.

The transaction will be implemented through a court-sanctioned scheme of arrangement under the laws of Jersey, where WNS is incorporated. It is subject to approval by the Royal Court of Jersey and WNS shareholders, in addition to standard regulatory clearances. Further details of the transaction will be made available in a scheme document filed with the US Securities and Exchange Commission (SEC).

Outlook and Performance

Capgemini stated that its financial targets for 2025 remain unchanged following the announcement. The company continues to forecast revenue growth between -2.0% and +2.0% at constant currency, an operating margin of 13.3% to 13.5%, and organic free cash flow of around €1.9 billion EUR.

The company also provided a brief update on its current performance, expecting its second-quarter 2025 year-on-year growth to be slightly improved from the -0.4% reported in the first quarter. The operating margin for the first half of 2025 is anticipated to be stable year-on-year at 12.4%.

Aiman Ezzat, CEO of Capgemini, and Keshav R. Murugesh, CEO of WNS, at the Capgemini headquarters. Photo credit: Capgemini.

Leave a Reply